NUMMA

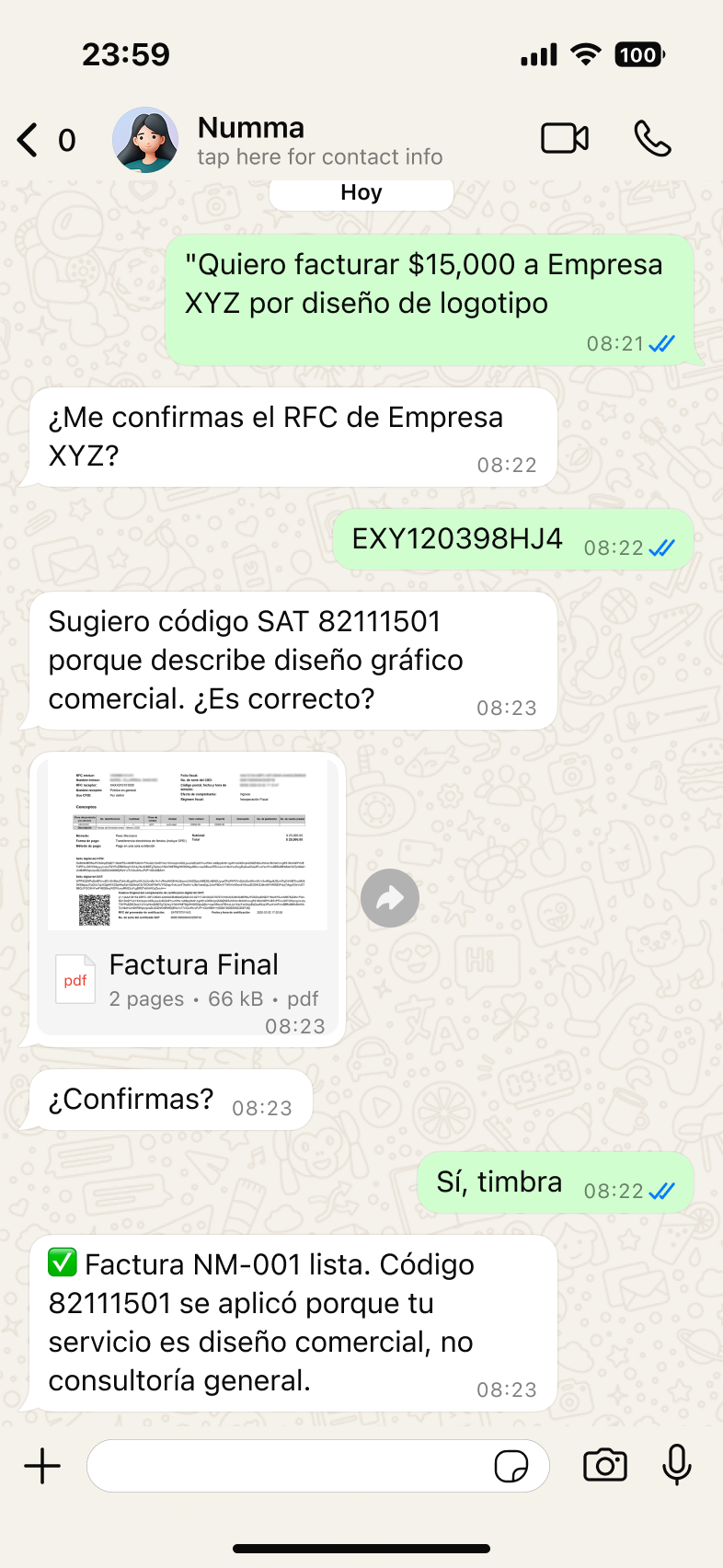

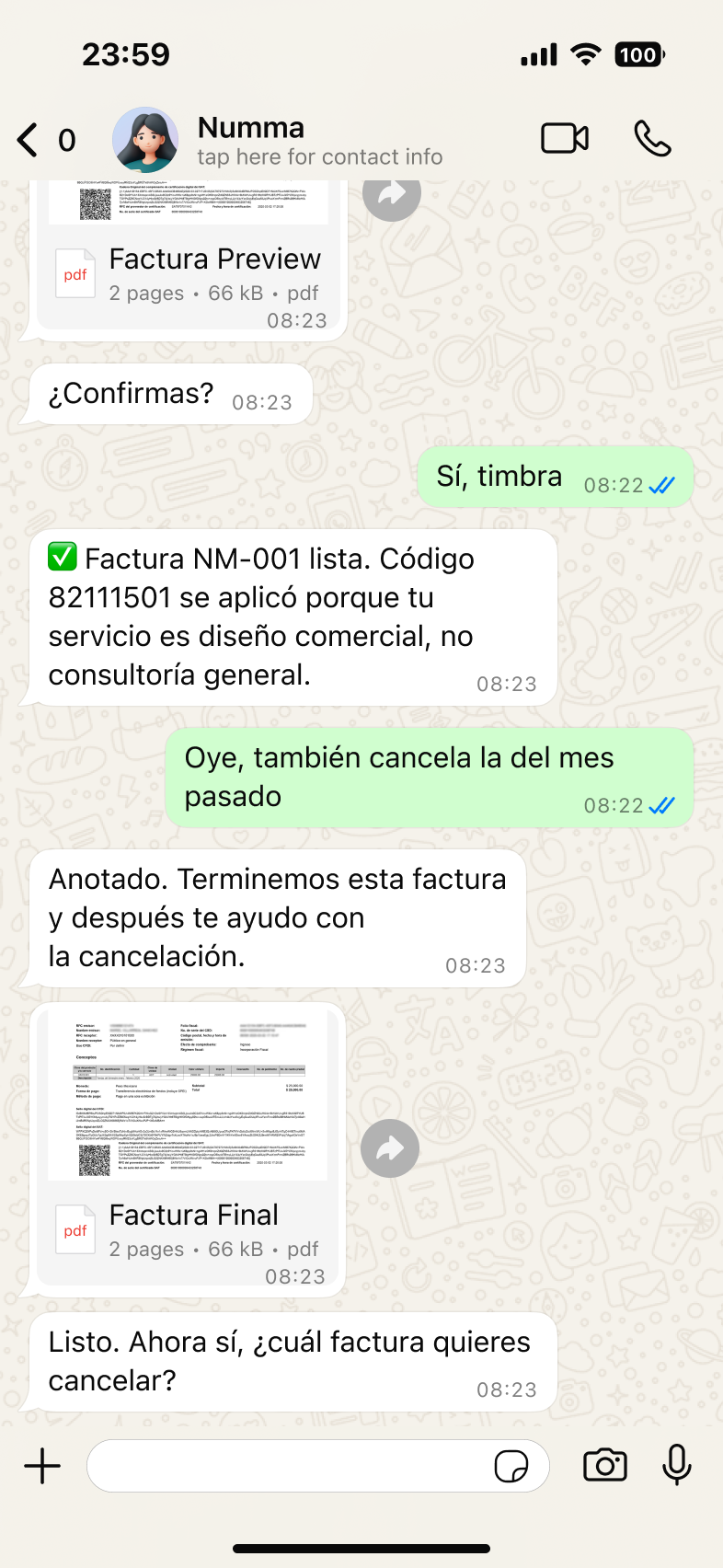

Designing an AI-First Invoicing Service for Mexico's Informal Economy

How ethnographic research with Mexican entrepreneurs revealed that speed trumps autonomy in cash flow optimization.

Co-Founder & Product Designer

6 months

AI Conversational Service Design